What’s Really in Your Retirement Accounts?

Why “Qualified” Doesn’t Always Mean “Safe”—and How to Rethink Your Retirement Strategy

If you're like most professionals, your retirement savings are stashed in "qualified" accounts—401(k)s, 403(b)s, IRAs.

You’ve done the right thing. You’ve saved consistently. You may even feel like you’re ahead of the game.

But here’s the truth:

🧨 Just because it’s qualified doesn’t mean it’s protected.

What’s a Qualified Term (Qt), Anyway?

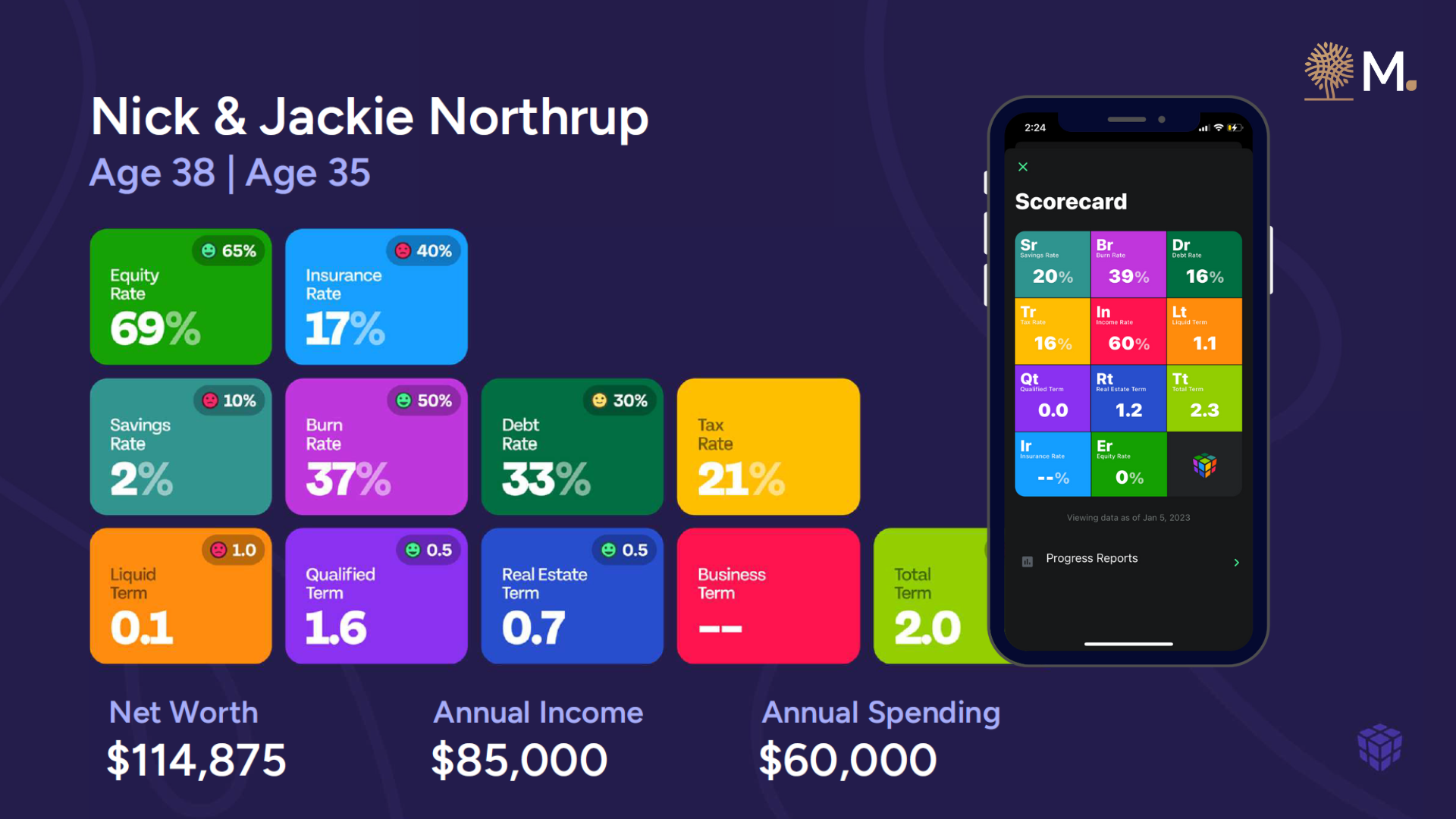

In the Elements system, your Qt tells us how much of your net worth is tied up in tax-deferred accounts—like 401(k)s or traditional IRAs.

That number matters.

Because every dollar in those accounts:

Will eventually be taxed

Can impact your Medicare premiums

Will be subject to Required Minimum Distributions (RMDs)

Might even push you into a higher tax bracket in retirement

You built it… but Uncle Sam gets a piece.

The Retirement Tax Bomb No One Warns You About

Let’s say your Qt is high—most of your retirement wealth is in tax-deferred accounts.

That means:

You’ve deferred taxes now… but will pay them later.

You may face a higher tax bill in retirement than you do today.

You’ve limited your flexibility for large purchases, gifts, or healthcare needs.

💣 It’s not just about how much you saved—it’s where you saved it.

When a High Qt Is a Red Flag

A high Qualified Term might signal:

🔻 Overconcentration in tax-deferred accounts

🔒 Lack of liquidity or access to funds without penalties

📉 Missed opportunities for Roth conversions, capital gains strategies, or giving

And here’s what most advisors miss:

A high Qt can amplify your risk in retirement—not reduce it.

A Better Way: Qt + Tr + Lt

At Meranti, we look at your Qt alongside two other Elements:

Tr (Tax Rate): How tax-efficient is your plan right now?

Lt (Liquid Term): How much of your wealth is truly accessible?

Together, these give us a 3D view of your flexibility, your tax drag, and how to make smart withdrawals later.

📊 Because retirement success isn't just about returns—it’s about control.

Want to Know Your Qt?

We make it easy.

In just a few minutes, our Elements Scorecard shows how much of your net worth is tied up in qualified accounts—and what that means for your future.

👇 Comment “Qt” below and I’ll send you a link to get started.

You’ll get:

✅ A free Elements Snapshot

✅ A simple visual of your Qt + Tr + Lt

✅ A personalized 10-min review call (optional)

This one number could reshape how you think about retirement—and how you plan for it.

#FinancialWellness #QualifiedAccounts #ElementsSystem #TrustYourStory #RetirementTaxPlanning #TaxEfficiency #QtElement #MerantiMethod #SmartRetirementPlanning